The fourth quarter of the skilled forecaster survey was launched Monday. Progress is predicted to speed up with out the yield curve inverting and triggering Sam’s rule.

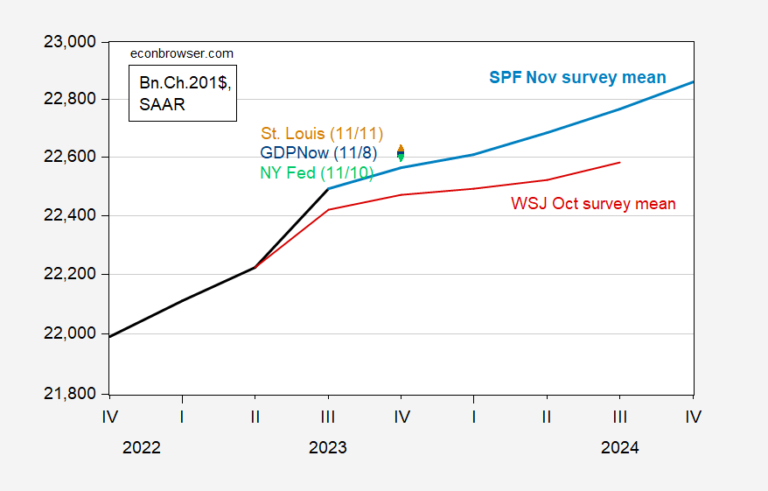

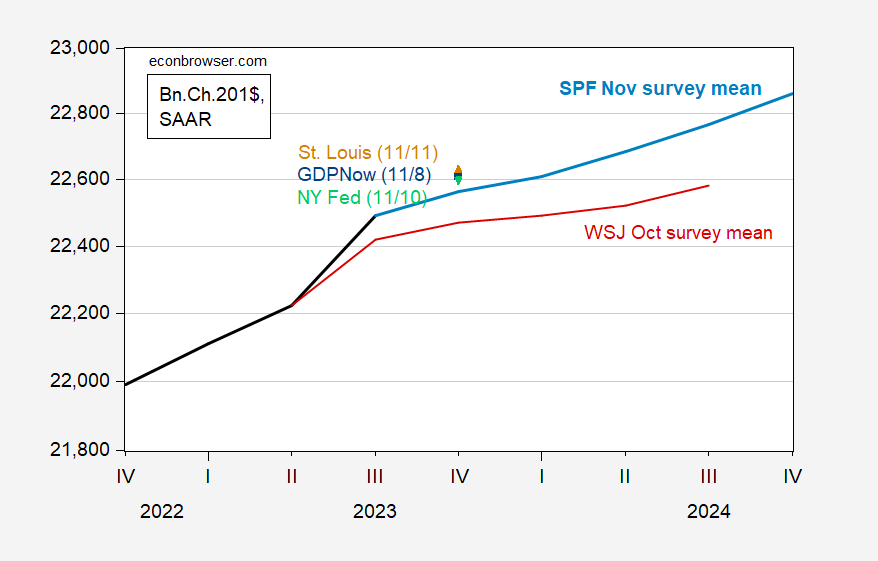

1. GDP:

determine 1: GDP report (daring black), GDPNow for 11/8 (blue sq.), New York Fed dwell forecast as of 11/10 (inexperienced inverted triangle), St. Louis Fed information dwell forecast (brown triangle), Wall Avenue Every day survey common (daring darkish purple), median SPF (mild blue), all in billions Ch. 2017$, SAAR. Stage calculated based mostly on pre-released GDP knowledge. Notice the logarithmic scale. Sources: BEA Q3 2023 Advances, Atlanta Fed, New York Fed, St. Louis Fed (through FRED, Wall Avenue Journal, Philadelphia Fed SPF), and creator’s calculations.

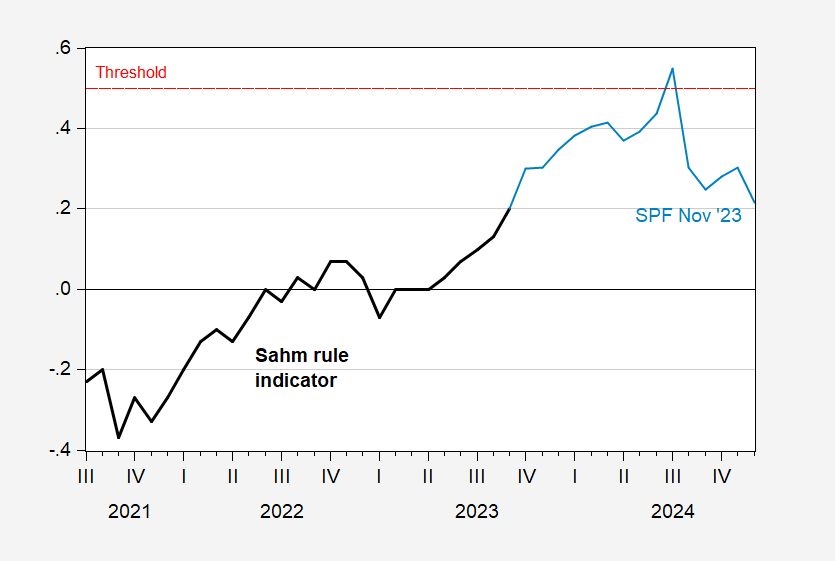

The trail to unemployment could be defined when it comes to Sam’s rule.

determine 2: Sahm’s rule immediate metric in % (daring black), and predicted SPF metric (mild blue). Quarterly forecast figures are quadratically interpolated to month-to-month. The purple dashed line is the 0.50% threshold. Supply: FRED, Philadelphia Fed SPF, and creator’s calculations.

This implies that Sam’s rule triggers in July, though the interpolation process makes exact month timing tough.

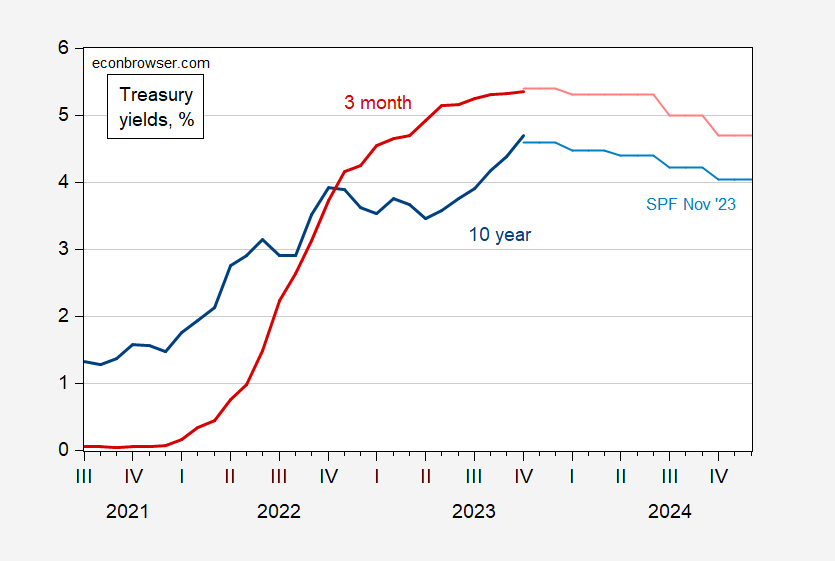

Rate of interest forecasts are for a peak within the fourth quarter of 2023.

picture 3: Three-month Treasury yields (daring darkish purple), three-month Treasury yield forecasts (purple), 10-year Treasury yields (darkish blue daring), and 10-year Treasury yield forecasts (mild blue ), all expressed in %. Supply: Treasury via FRED and Philadelphia Fed SPF.

For This autumn 2023, the 10-year forecast is 4.6%, in contrast with the three.9% forecast within the final survey (August). Peak charges are postponed from the third quarter of 2023 to the fourth quarter of 2023.